USA State Payroll Rates + Resources: State of Alabama: Unemployment Insurance Reporting & Payments

Purpose

The purpose of this documentation is to outline the processes and requirements associated with Unemployment Insurance Reporting & Payments to the proper authorities in the state of Alabama.

Unemployment Insurance Reporting & Payments

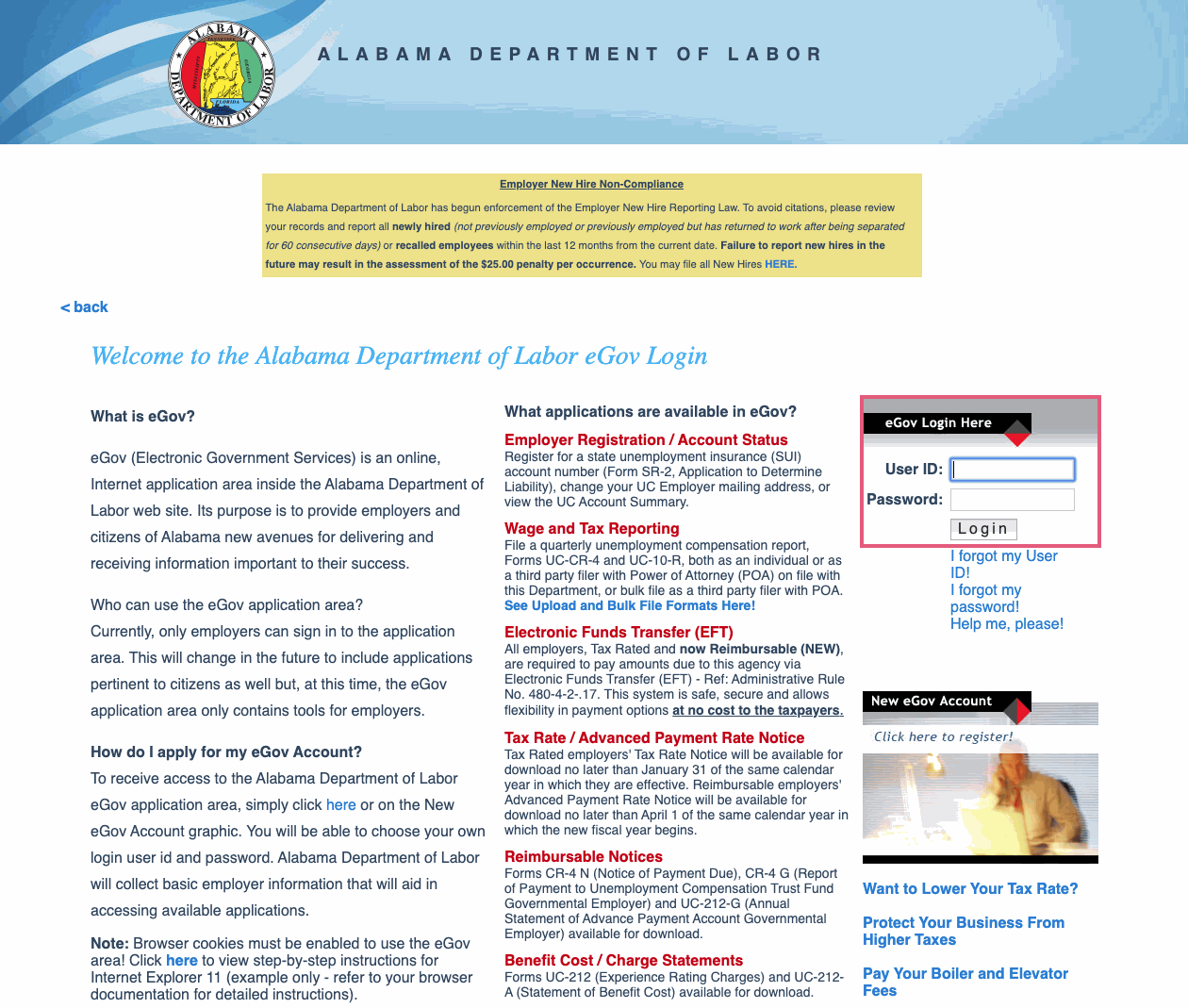

All employers who are liable for unemployment insurance must file quarterly unemployment compensation reports and pay quarterly UI payments online via the Alabama Department of Labor eGov website. From their home page, enter your User ID and Password you obtained during registration.

Reports and payments are due the end of the month following the end of the quarter your are reporting on.

| Quarter | Months in Quarter | Due Date |

| 1st Quarter | January - March | April 30th |

| 2nd Quarter | April - June | July 31st |

| 3rd Quarter | July - September | October 31st |

| 4th Quarter | October - December | January 31st |

For more information see Employer Information.