USA State Payroll Rates + Resources: State of Arizona: Filing State Income Taxes, W-2s, and 1099s

Purpose

The purpose of this documentation is to outline the processes and requirements associated with filing state income taxes as well as how to file W-2s and 1099s, if needed, in the state of Arizona.

State Income Tax Withholding

To determine the amount of state of Arizona income tax withholding, employees should complete an Arizona Form A-4, Arizona Withholding Percentage Election within five days of employment. Existing employees may also complete the form to change the previous withholding amount or percentage.

Employees who expect no Arizona income tax liability for the calendar year may claim an exemption from Arizona withholding. This exemption must be renewed annually, similar to federal requirements.

Also, individuals with a current withholding percentage elected on Arizona Form A-4P or Arizona Form A-4V may also complete a new form to change the previous withholding amount or percentage.

Employers are required to keep copies of completed state A-4 forms for their employees in their files. The forms serve as verification that state income taxes are being withheld according to the employee’s instructions and needs to be available for inspection if the state requests it.

State Income Tax Withholding Reporting & Deposits

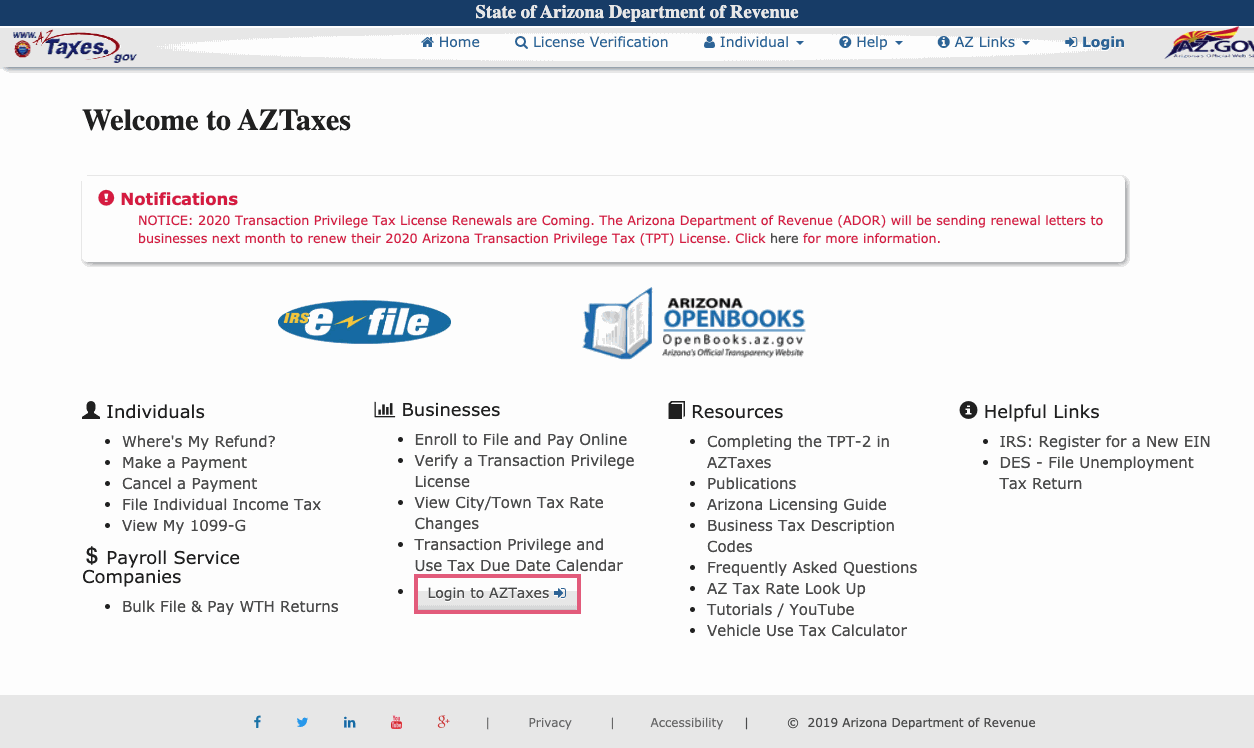

For withholding tax, any taxpayer with $2,500 average quarterly liability for withholding tax during the prior tax year must file and make EFT payments electronically at www.AZTaxes.gov using login information obtained and set-up with their TPT application (JT-1) - see Obtaining a TIN + Unemployment Insurance). Click on "Login to AZTaxes".

For Arizona withholding tax purposes, several deposit schedules may apply. The schedule that an employer must use depends on the amount of Arizona tax withheld. These schedules are based on the average amount owithheld during the prior 4 quarter period. The employer must compute this average at the start of each new quarter. The deposit schedule that may apply for one quarter may not be the same schedule that applies to the next.

| Previous 4 Quarter Arizona Withholding Average | Arizona Deposit Schedule | How to File |

| $0-$200 (must have been in business for at least a year and must have established a specified tiling and payment history) | Annually January 31 of the following year | A-1 APR, Annual Payment Withholding Tax Return or through www.AZtaxes.gov |

| $201 - $1,500 | Quarterly Due the last day of the month that follows the end of the quarter you are filing for. | A1-QRT, Quarterly Withholding Tax Return or through www.AZtaxes.gov |

$1,500+ | Same time as Federal (Monthly, Semi-weekly, Next Business Day) See IRS Deposit Requirements for due dates. | A1-QRT, Quarterly Withholding Tax Return or through www.AZtaxes.gov |

W-2 and 1099 Forms

Form A1-R is an annual return filed to summarize the total compensation paid and tax withheld for each employee during the calendar year.

Employers that file Form A1-QRT must file Form A1-R to reconcile the amount of tax withheld during the year to the amount of tax liability reported during the year. Form A1-R is also used to transmit federal Forms W-2, W-2c, W-2G (with Arizona withholding) and 1099-R (with Arizona withholding).

Form A1-R is filed on a calendar basis and is due by January 31st of the following year.

If a paper Form A1-R is filed, attach federal Forms W-2, W2c, W-2G (with Arizona withholding) and 1099-R (with Arizona withholding) to Form A1-R.

If Form A1-R is filed electronically on www.AZtaxes.gov, use Form A1-T to transmit federal Forms W-2, W-2c, W-2G (with Arizona withholding), and 1099-R (with Arizona withholding).

For more details, see the Arizona Withholding Reconciliation Return instructions.

Good to Know!

The state of Arizona only requires the filing of Form 1099-R only. (Not form 1099-MISC)